Dealing with IFRS

We can help he adoption and implementation of IFRS (International Financial Reporting Standards).

Let us know if you need this service.

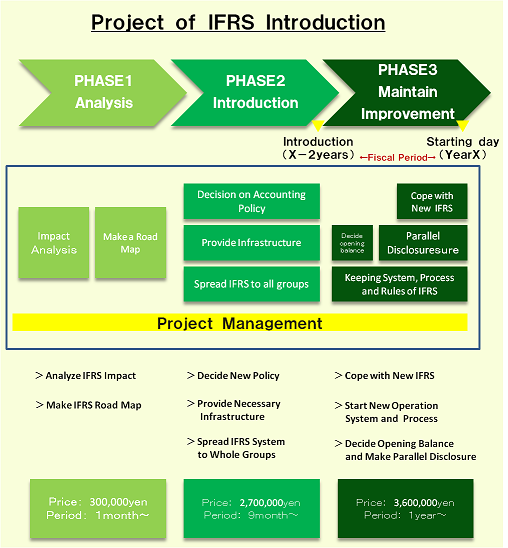

3 phases of IFRS adoption procedure

The fees of IFRS adpotion services are different according to each phases.

Let us estimate for each cases.

Please feel free to contact us.

Introduction example

Our representative, Ryohei Morinaga has dealt with the cases below.

Company A

Trading Industry/Parent Group Company with 10 Subsidaries (incl. foreign subsidaries).

Capital of 4 billion yen with 150 employees (400emplyees for all groups)

Capital of 4 billion yen with 150 employees (400emplyees for all groups)

Company B

IT Industry/Parent Group Company/with 7 Subsidaries (incl. foreign subsidaries).

Capital of 2 billion yen with 20 employees (450emplyees for all groups)

Capital of 2 billion yen with 20 employees (450emplyees for all groups)

Company C

IT Industry/Parent Group Comany with 5 Subsidaries (incl. foreign subsidaries).

Capital of 1.5 billion yen with 50 employees (80emplyees for all groups)

Capital of 1.5 billion yen with 50 employees (80emplyees for all groups)

Company D

Apparel Industry/Parent Group Company with 2 Subsidary Company.

Capital of 2 billion yen with 100 employees (120emplyees for all groups)

Capital of 2 billion yen with 100 employees (120emplyees for all groups)

Comparison between IFRS and Japan GAAP (J-GAAP)

|

|

GAAP | IFRS |

| 1.Measurement Criteria | Acquisition cost |

Cost model or reevaluation model (IAS16.15,29,30,31) |

| 2.Depreciation Method | Generally up to the taxation. | Up to the consumption pattern of economic benefit of property. (IAS16.60) |

| 3.Useful Life | Generally the life of Corporation Tax Law | Economic useful life (IAS16.56) |

| 4.Unite of Depreciation | Generally follow the classification under the useful life of Corporation Tax Law. |

Classified into the component of assets, and amortized based on useful life, salvage value, and depreciation method. (IAS16.43,60) (component counting) |

| 5.Change in Depreciation Method | Must be processed as Accounting Change. However the change itself has to be treated as Accounting Estimates, no concession. | Must be processed as Accounting Estimates. (IAS16.51,61) |

| 6.Capitalization of Borrowing Costs | Possible to capitalize if it meets certain requirements in Real Estate Development | Possible to capitalize if it meets certain requirements(admissible asset)-coercion rule, since 1,1,2009 (IAS23) |

| 7.an investment property | Disclose the current price of Rental Real Estates at the end of the fiscal year | Measured by fair value model, and gains and losses are recorded in profit and loss(guiding principles)or notes of fair value information is needed when cost model is applied. (IAS40) |

For further information, please see the links below!

|

Services

|

Why Us?

Voices

Acheivements |

Copyright (C) 2013 森永会計事務所 All Rights Reserved.